Shopper insights in action: 4 success stories

How can consumer packaged goods (CPG) brands adapt to shoppers’ evolving purchase habits and behavior to stay relevant and drive continued growth? The answer lies in utilizing insights about shopper motivations, attitudes and preferences to drive effective strategy shifts. Here are four examples of how brands such as an energy drink company, a confectionery business and others transformed shopper insights into actionable strategies.

1. Uncover new relevant audiences

By tapping into other insight sources, such as retail purchase signals, brands can learn more about category purchase trends and other insights to find more relevant audiences, such as households that purchase similar brands and complementary items. For instance, Kroger Precision Marketing helped an energy drink company bring back fans as well as attract new households by drawing on shopper insights powered by 84.51° to recommend the best households for a connected TV ad campaign.

The end result: A 4.7x average ROAS for a highly efficient TV spend with precision targeting.

2. Align products and promotions with shopper preferences

If sales are declining, identifying the root of the problem is crucial to inform next steps. For example, a confectionery company wanted to understand if its declining checklane gum sales was due to households buying gum elsewhere in the store, switching to competitors or leaving the category all together.

To answer their questions and build a more robust strategy, the company accessed the 84.51° Stratum Switching and Modality (e-commerce) reports. These reports became instrumental for understanding that gum sales from the checklane had shifted to in-aisle UPCs, as consumers shopped for larger pack sizes.

The end result: The company determined how to better manage their portfolio and promotional strategies, with the knowledge that shoppers were seeking out larger pack sizes.

3. Understand what is important to shoppers

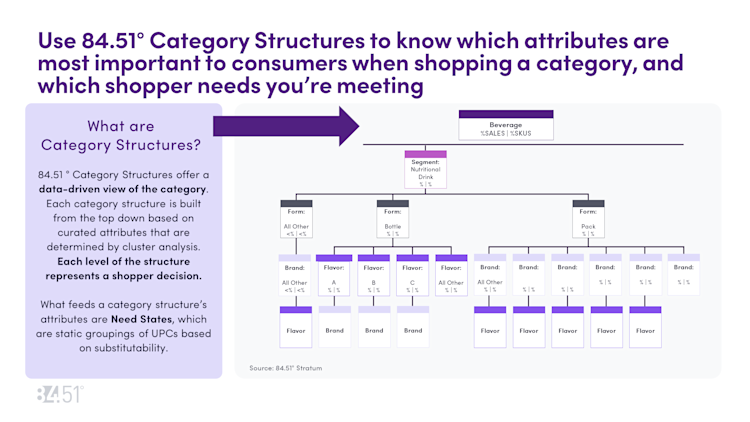

A sports nutrition company sought to determine how consumers were shopping within a category and which product attributes were most important to them. 84.51° put together an attribute dendrogram (Category Structures) using the brand product as the data input. From there, we were able to analyze consumer purchase patterns and cluster items based on the degree of substitutability. The results helped the sports nutrition company identify which products within their portfolio were driving purchase behavior. The end result: Using the dendrogram, the company determined that form is the most crucial attribute for assortment guidance, with both ready-to-drink and powder forms having specific use cases. They also identified other attributes such as flavor, sub-brands and protein content, and determined their importance based on form, allowing them to create recommended assortments that balance loyalty and variety driving attributes.

Sample

4. Make a case for new sales opportunities

A maker of breakfast foods was looking to expand its frozen breakfast multi-pack and single-serve items at retailers who only carried one pack size type, as retailers believed it was best not to duplicate items with the same flavors on shelves.

The company used 84.51° Stratum cross shop and custom segmentations to demonstrate that different pack sizes engage different shoppers and carrying items across pack sizes leads to increased spending and unit sales.

The end result: The company successfully expanded pack size type distribution at multiple large, national retailers.

Know your shopper

The key takeaway is that understanding shoppers is the cornerstone of success. These examples underscore the importance of a data-driven approach to understanding and meeting shopper needs. By tapping into comprehensive insights and adapting strategies accordingly, CPG brands can not only retain their existing customer base but also attract new audiences, ultimately driving growth and success in a competitive market. From actionable insights to media precision, find out how we can solve your business challenges.

Visit our knowledge hub

See what you can learn from our latest posts.

![[DO NOT DELETE] 8451-PR header 4000x2000 shutterstock 2146084959 po](https://images.ctfassets.net/c23k8ps4z1xm/CUmZcselsJUhnLz6rQuj2/0e48394e72423bb1073bf8bb6cf75974/8451-PR_header_4000x2000_shutterstock_2146084959_po.jpg?w=328&h=232&fit=fill)