Plant-based food market sees continued growth as consumer concerns decline

New research reveals shifting consumer attitudes and opportunities for industry growth

Consumer appetite for plant-based foods continues to grow steadily, according to recent market research. The data shows not only an increase in consumption but also a significant decline in traditional barriers that once prevented consumers from embracing plant-based alternatives.

"The plant-based food industry has grown tremendously over the past six years going from 4.5 billion in 2018 to over 8 billion in 2024. We've entered the mainstream. 59% of US households are now purchasing plant-based products and 79% of those households are repeating that purchasing behavior," notes Hannah Lopez, Head of Marketplace at the Plant Based Foods Association.

Consumer trends point upward

The latest industry data reveals that 34% of shoppers report increasing their consumption of plant-based foods, while 57% are maintaining current levels. Only 9% indicated they are consuming less—painting a picture of a market with strong momentum.

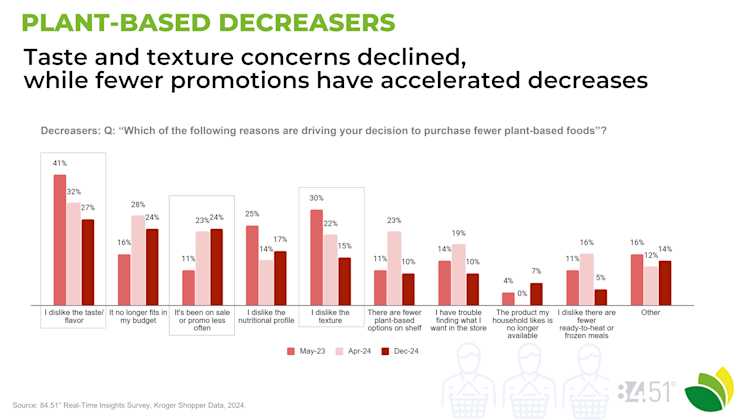

Perhaps more telling is the dramatic decrease in concerns that previously limited consumer adoption. Taste concerns, historically the biggest barrier to plant-based food adoption, have dropped from 41% to 27% since 2023. Similarly, texture concerns plummeted from 30% to 15%, while nutritional profile concerns fell from 25% to 17%.

"These are all really positive trends that are highlighting the reactive behavior that brands are doing in the manufacturing space. They're listening to the consumer and they're meeting those unmet needs," explains Lopez.

Key motivators driving growth

The research identified three primary motivations behind consumers' shift toward plant-based options:

Health benefits remain a top driver, with consumers increasingly aware of the potential health advantages of plant-forward diets

Sustainability concerns continue to gain traction, with environmental motivations growing from 30% to 36% in 2024

Animal welfare considerations remain a consistent factor in consumer decision-making

Consumer perceptions about taste and flavor have also improved significantly, jumping from 23% to 36%—suggesting that product innovations are making a measurable impact in the market.

"What I get most excited about is the taste. And seeing that grow incrementally year over year is a really positive sign that brands are listening to the consumer," says Lopez.

The Balance of Value and Values

Patrick Coyle, Chief Marketing Officer of nutpods, a top plant-based coffee creamer brand in the country, emphasizes that success in the plant-based sector requires understanding the interplay between pricing and principles.

"There's a balance between value and values," explains Coyle. "I would love to say that it's animal welfare and environmental and things like that. But it's not, it's value, it’s taste, it’s performance. It's all the things that you would expect that would be the key drivers."

This highlights a critical insight for brands: consumers want products that align with their values but won't compromise on fundamental aspects like taste, texture, and perceived value.

Actionable strategies for plant-based brands

For plant-based food manufacturers looking to capitalize on these positive trends, the research offers several clear pathways to continued growth:

Prioritize accessibility and affordability

Consumers explicitly identified promotions and discounts as key factors that would make plant-based shopping easier. However, brands need to be strategic in their approach to pricing.

"From a brand perspective, you don't want to be on promotion all the time," Coyle advises. "Not from a margin standpoint, but from a brand perception standpoint, you don't want to be the brand that's always on sale."

Instead, brands can work with retailers on targeted promotional strategies that attract new customers without devaluing the product.

Enhance consumer education through experience

"If you have a brand, it's your duty, your job to work with your retailer or food service manufacturer operator on educating the consumer," emphasizes Lopez. "So storytelling and the narrative and also partnering with a retailer on a promotional strategy that's led by data just makes that conversation much more impactful."

In-store sampling, demos, and clearer product labeling were highlighted as effective ways to overcome remaining hesitations. Brands should consider investing in experiential marketing that allows consumers to taste products before purchasing.

Improve product findability

Strategic merchandising is crucial for category growth. "If your product is not merchandised in the right subset of the store, you're not going to be found," says Lopez. "We are living in a very fast paced life where if it's really difficult for us to find the product, we're probably just going to grab something and go."

Coyle adds: "One of the things that retailers have done a great job of, but we can even do a better job of, is leveraging the limited amount of display that is available in-store to introduce consumers to brands they wouldn't have considered otherwise."

This applies to both physical and digital shelves. As Maureen Heis, Director of Commercial Account Management at 84.51°, explains: "Everybody has an equal right to win at the digital shelf. What 84.51° can help you do is boost your presence on site."

Data-driven approach to growth

For brands looking to implement these strategies effectively, data analytics can provide crucial insights. Heis notes that personalization is now "table stakes" in consumer engagement.

"We can personalize the content for the audience, reach the audience at scale and measure the impact of it at the end of the day," she explains. "We can try to differentiate the content so that we're serving the right message to the right shopper."

Tools that help personalize promotions, enhance digital visibility, and measure marketing impact allow brands to refine their approaches based on real consumer behavior.

"We look here at the study to talk about plant-based as a whole. What we could do is look at a commodity or a sub-commodity in more specifics to understand what are the white space opportunities in that specific commodity and what are the unmet needs for those shoppers," Heis suggests.

The path forward

As consumer interest in plant-based foods continues to grow and concerns diminish, brands that respond strategically to these market signals are positioned to thrive.

"As an industry, our next steps really should be around prioritizing accessibility, affordability and promotions, innovating beyond traditional categories and strengthening consumer education," concludes Lopez.

With continued focus on these priorities, the plant-based sector is well-positioned for sustained growth in the coming years.

SOURCE: 84.51° Real-Time Insights Survey, Kroger Shoppers, 2024.

Visit our knowledge hub

See what you can learn from our latest posts.

![[DO NOT DELETE] 8451-PR header 4000x2000 shutterstock 2146084959 po](https://images.ctfassets.net/c23k8ps4z1xm/CUmZcselsJUhnLz6rQuj2/0e48394e72423bb1073bf8bb6cf75974/8451-PR_header_4000x2000_shutterstock_2146084959_po.jpg?w=328&h=232&fit=fill)