Consumer Digest: Student Loan Repayments Resume September 2023

Welcome to the September edition of the Consumer Digest, where we aim to provide relevant informative and actionable insights around consumer trends. With student loan repayments set to resume, we are looking at shoppers’ concern level and what adjustments they plan to make to their budget. From there, we’ll look at how consumers plan to protect themselves during cold & flu season. Finally, we’ll wrap up with what shoppers want the future of grocery shopping to look like.

Financial discomfort holding steady in September

Shopper comfort about finances – % of Household Comfort (Monthly)

17% said very comfortable

61% said comfortable

22% said not comfortable

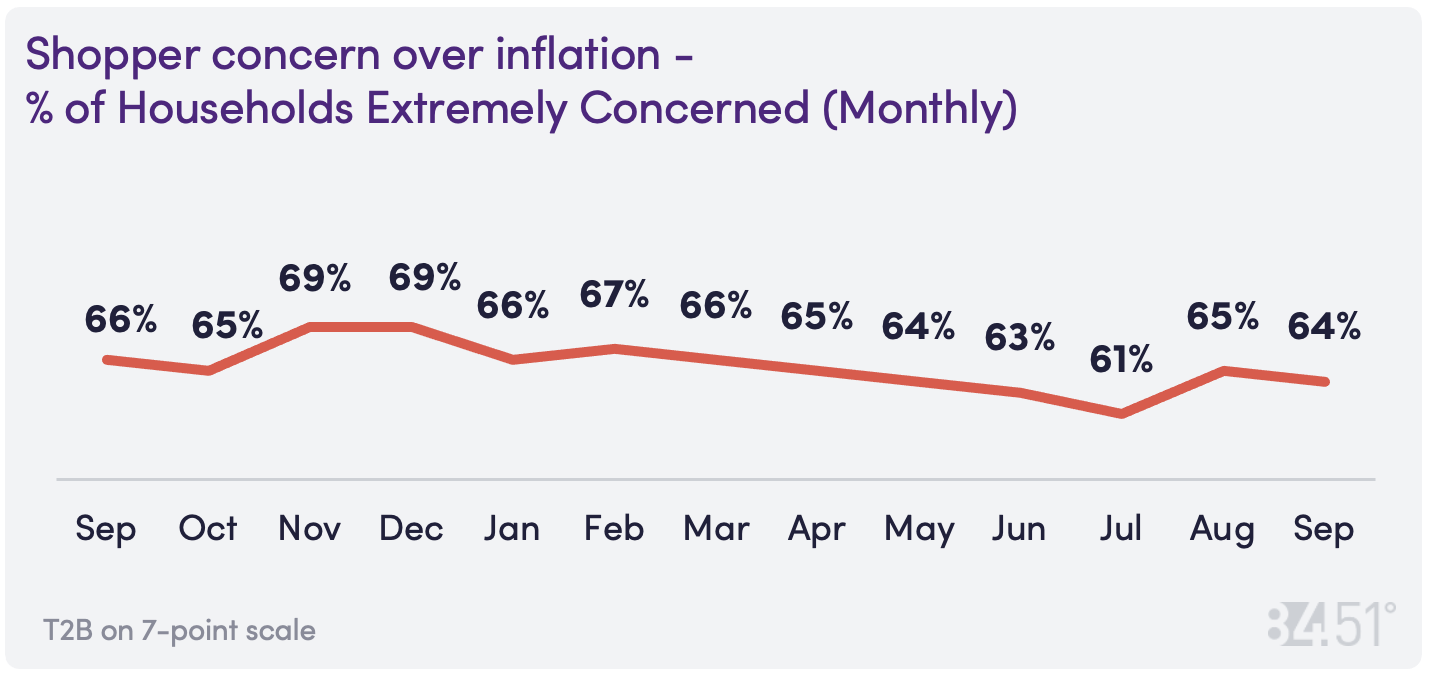

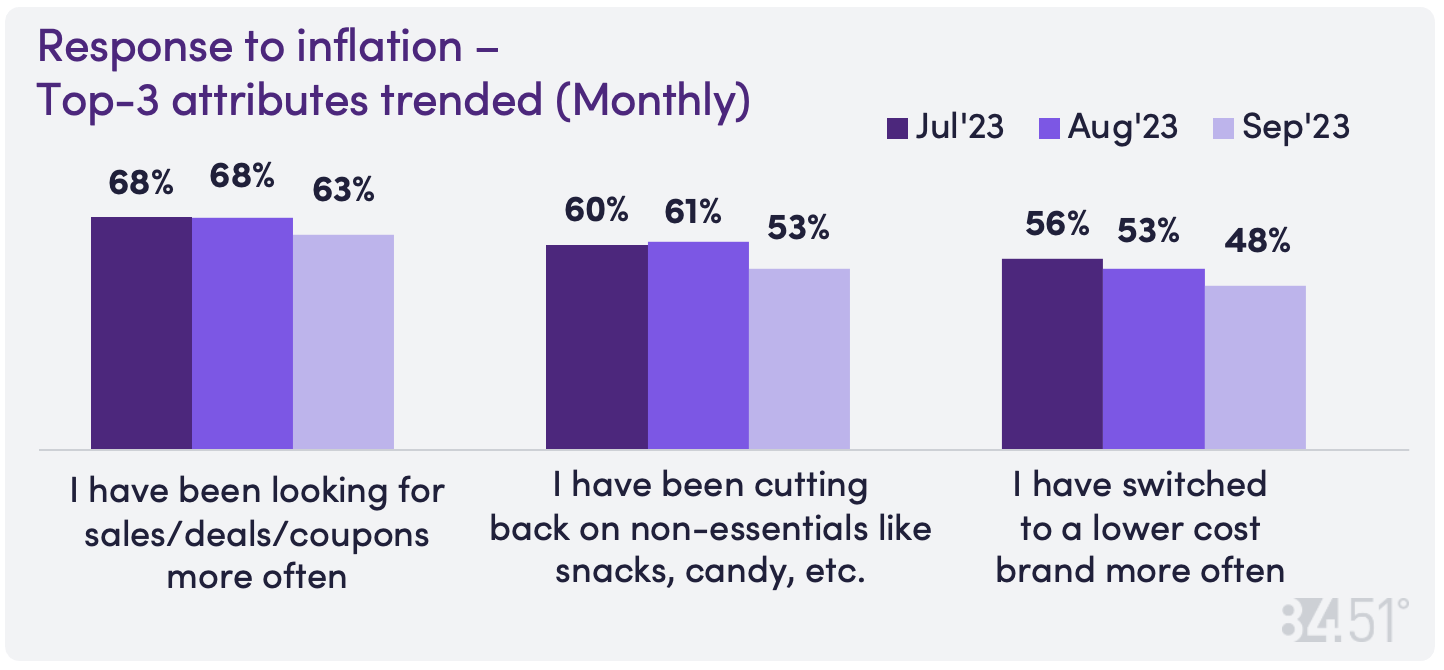

How shoppers respond to inflation

In September, concern over inflation trended flat though fewer shoppers felt the need to offset inflation impact with money-saving tactics like cutting back on non-essentials or choosing less expensive brands compared to previous months.

We’ve noticed a positive shift in levels of financial comfort among shoppers with only 22% claiming they are not comfortable with their finances, which is a 5% decrease from August.

Back to school spending – a “say/do” gap

Feeling the pressure of rising prices, half of shoppers for back-to-school items claimed in early August that they planned to buy fewer school supplies or were going to reuse school supplies from last year.

Say:

Are you planning to buy fewer school supplies this year? (Asked in early August) 51% of respondents answered Yes.

Are you likely to reuse most of your school supplies from prior years? (Asked in early August) 52% of respondents answered Yes.

Do:

+3% increase in BTS/College food & non-food items vs. last year

Student loan repayments will impact discretionary spend

According to Credit.com, 13% of the US population has some form of student loan debt. 20% of our respondents claim that either themselves or someone in their household have student loan debt.

49% of respondents with student loan debt are extremely concerned with their ability to maintain their monthly budget when student loan forbearance period ends in October. ~70% of these respondents claim they/people in their household have not been making payments during the forbearance period.

When we asked respondents which of the following categories, if any, do they plan to cut back spending due to upcoming student loan payments, they said:

More likely place to cut back

58%: Dining out/Take-out

49%: Outside of home entertainment

44%: Food delivery services

42%: Travel

37%: Beauty services

37%: Clothing

29%: Home improvements

29%: Savings

Less likely place to cut back

27%: Groceries

22%: At home entertainment

18%: Cleaning, beauty, personal care essentials

13%: Investments

11%: Transportation

5%: Housing

13%: None of the above

‘Tis the season for Cold & Flu…

Respondents are most likely to say they will wash hands more often, take vitamins and use hand sanitizer to protect themselves during the upcoming cold & flu season.

When asked what preventative measures they are planning to take to help protect themselves and their household, respondents said:

64%: Washing hands more often

62%: Vitamins/supplements

56%: Using hand sanitizer

54%: Getting a flu vaccine

44%: Antibacterial cleaning products

43%: Healthy/immunity boosting foods

39%: Annual physical

38%: Getting a COVID vaccine

25%: Wearing a mask

20%: Visiting public places less often

What will consumers stock up on this upcoming Cold & Flu season?

Over 40% said:

Tissues

Hand Sanitizer/ Soap

Cleaning Products

30-38% said:

Everyday Multi Vitamins

Cough Drops/ Lozenges

Acetaminophen

OTC Cough Medication

Ibuprofen

24-27% said:

OTC Decongestants

OTC Antihistamines / Allergy

Tea

Canned or Boxed Soup

Immunity Products / Vitamins

9-18% said:

Natural Remedies

Homeopathic Products

Thermometer

21% do not plan to stock up

Holiday celebrations abound

33% of shoppers are excited for holidays but indicate mixed feelings about shopping plans.

Store selection: Shoppers will either choose the same grocery store as normal or go to one with steeper discounts.

Price concern: Shoppers are concerned about budgets and may spend less this season; early shopping helps spread out expenses.

Planning ahead: >20% have started planning for Halloween, Thanksgiving, and/or Christmas.

Hispanic Heritage Month

Though only 7% of shoppers celebrate Hispanic Heritage month, shoppers enjoy this cuisine at restaurants, through takeout/ delivery, or at home. When asked about multi-cultural cooking:

44% say their preferred grocery store offers ingredients they need

41% enjoy trying new multi-cultural dishes

26% look for inspiration on social media to cook dishes at home

Halloween

Shoppers are planning to celebrate Halloween in a traditional way this year. While 34% will not cut back on expenses, 36% will cut back on decorations, 32% on costumes, and 27% on beverages.

When asked how they anticipate members of their household celebrating Halloween this year, respondents said:

59%: Decorate my house

50%: Carve a pumpkin

44%: Stock up on candy for the household

40%: Stock up on candy for trick-or-treaters

40%: Stay home and hand out candy

Grocery shopping in the future – what customers want

With the rise of eCommerce and digital capabilities, shoppers are hungry for new grocery experiences and ways to save. Customers are very interested in new technologies to make shopping easier and more experiential. While shoppers are interested in evolving the grocery shopping experience, the modalities of the future mirror those available today – 71% imagine continuing Pickup, 70% imagine continuing in-store, and 60% imagine continuing delivery (does not add to 100% as shoppers chose multiple modalities).

Which of the below experiences are part of your regular grocery shopping trip today?

63% Use self-checkout

53% Use grocery store apps to find digital coupons

45% Use grocery store apps to find savings

23% Use grocery store apps to find items in-store

23% Use grocery store apps to find items online

92% of Kroger shoppers use coupons for grocery and household items today. When asked if they use paper or digital coupons for groceries & household items, they said:

37% Digital coupons only

8% Paper coupons only

48% Digital and paper coupons

8% None

Which of the below grocery shopping experiences would interest you in the future?

38% Smart Carts that calculate cost of groceries in real-time and allow you to skip check-out

33% More taste-testing stations and product demonstrations

25% Digital screens on shelves that display ads, nutrition labels, and pricing/promotions

20% Digital screens on cooler doors that display ads, nutrition labels, and pricing/promotions

15% Text based customer service / smart appliances (responses tied for 5th)

In the future, shoppers would like to save money in new ways. When asked their interest in the following ways to save money, respondents said:

71% Universal coupons to use across retailers

70% Auto-loaded personalized digital coupons

52% Free grocery delivery

50% Personalized paper coupons to pick up in-store

45% Loyalty rewards to lower delivery fees

40% Reusable product containers to save money

38% Reduced threshold for free delivery

In open-ended responses, shoppers were asked to describe grocery shopping ideas they wished existed today. Key themes fall into 3 categories:

Price

Lower prices

More discounts/rewards

Digital coupons/rewards

Ease & Quality

Better customer experience

Easier/faster checkout

More organized stores

Better quality products

Technology

Delivery options

Virtual shopping

Product scanning/spend tracking in real-time

Want to dig deeper?

Each month. 84.51°’s Consumer Digest Report delivers relevant and actionable insights around consumer trends directly to your inbox. Now, for an incremental investment, 84.51° invites you to explore these insights the way you want via the 84.51° Consumer Digest Dashboard.

SOURCE: 84.51° Real Time Insights, September 2023

Visit our knowledge hub

See what you can learn from our latest posts.

![[DO NOT DELETE] 8451-PR header 4000x2000 shutterstock 2146084959 po](https://images.ctfassets.net/c23k8ps4z1xm/CUmZcselsJUhnLz6rQuj2/0e48394e72423bb1073bf8bb6cf75974/8451-PR_header_4000x2000_shutterstock_2146084959_po.jpg?w=328&h=232&fit=fill)