Consumer Digest: Omnichannel Trends February 2025

Who is the omnichannel shopper?

The omnichannel shopper is someone who buys their grocery and household needs both online and in-store. They are also called hybrid shoppers.

The omnichannel shopper is more likely to be:

Millennial (215 Index)

Have children (178 Index)

Highly Engaged with Natural & Organic (140 Index)

High Convenience Seekers (135 Index)

Larger HHs, 5+ (132 Index)

…than the in–store shopper.

Omnichannel defined by the shopper: What do they expect to be same/similar when shopping the same retailer online & in-store?

49%: I expect everything to be the same

36%: Pricing is the same online & in-store

34%: Coupons available are the same

SAY – 55% of omnichannel shoppers say they shop mostly online, and some in-store.

55%: Mostly online, some in-store

25%: Mostly in-store, some online

20%: Online and in-store equally

DO - Omni-shoppers still make 83% of their trips in-store

83% of Trips are In-store

17% of Trips are Pickup/ Delivery

Reasons omnichannel shoppers choose to buy online and in-store…

Overwhelmingly, omnichannel shoppers use pickup and delivery for convenience, with 86% citing it as the reason they shop those methods.

Why do they shop online for Pickup or Delivery?

Top 5 reasons omnichannel shoppers shop in-store are more varied and are more merchandising related.

Why do they shop In-Store?

45%: Product availability (e.g., in stock)

43%: Sales and promotions

42%: Selection/assortment

37%: Location

35%: Easy to navigate the store

While they choose to shop pickup & delivery primarily for convenience, omnichannel shoppers also put heavy emphasis on Price/Savings when shopping online:

Savings features & the ability to build a cart throughout the week are among omnichannel shoppers’ favorite features when shopping online

Favorite features of online grocery

79%: Digital coupons

58%: Ability to build a cart throughout the week

57%: Promotional offers and weekly ads

48%: Recent purchases and product suggestions

46%: ‘On my way’ feature for pickup orders

43%: Tracking order progress

The average online basket is built in 2.2 sessions per order.

Better savings, reduced fees, & product selection would encourage omnichannel shoppers to shop more online:

57%: If the price or savings were better online

49%: If there were lower fees for online services (e.g. delivery fees, driver tips, etc.)

36%: If I was confident someone could select the items I want

31%: If I could get a certain product or brand online that I couldn’t get in-store

25%: If there was more selection of products

Other reasons include:

24%: If it was more convenient or would save time

21%: If it was easier to find items online

18%: If there was faster delivery

13%: If the shopping experience was more personalized

Preferences for Online vs. In-store

When directly comparing shopping methods, Omnichannel shoppers choose to shop online vs. in-store because it fits their lifestyle.

Top reasons to shop online vs. in-store:

67%: To save time

55%: I can shop from any location any time of day

50%: Ability to stay away from crowds

They choose to shop in-store vs. online because in-store shopping helps meet specific item needs and allows them to have control.

Top reasons to shop in-store vs. online:

47%: If it’s a special trip to buy a specific item

42%: I don’t want to meet a minimum order requirement

38%: I don’t want to worry about getting the wrong item

67% of omnichannel shoppers say they choose to shop online over in-store to save time, but when asked about time spent ordering, only 53% say they spend less time ordering online

53%: I spend less time ordering online

28%: I spend about the same amount of time

19%: I spend more time ordering online

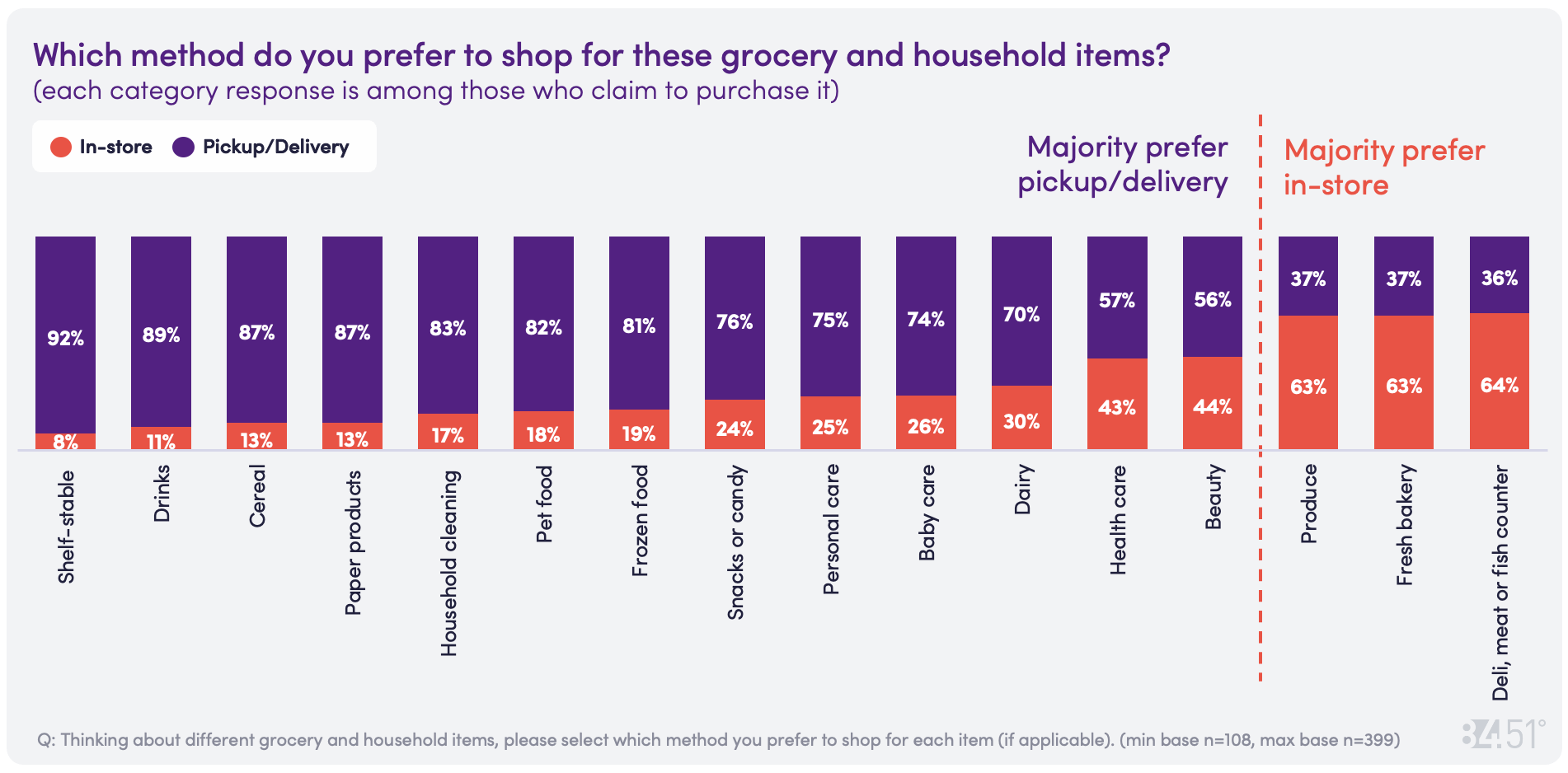

Shopper preferences among categories

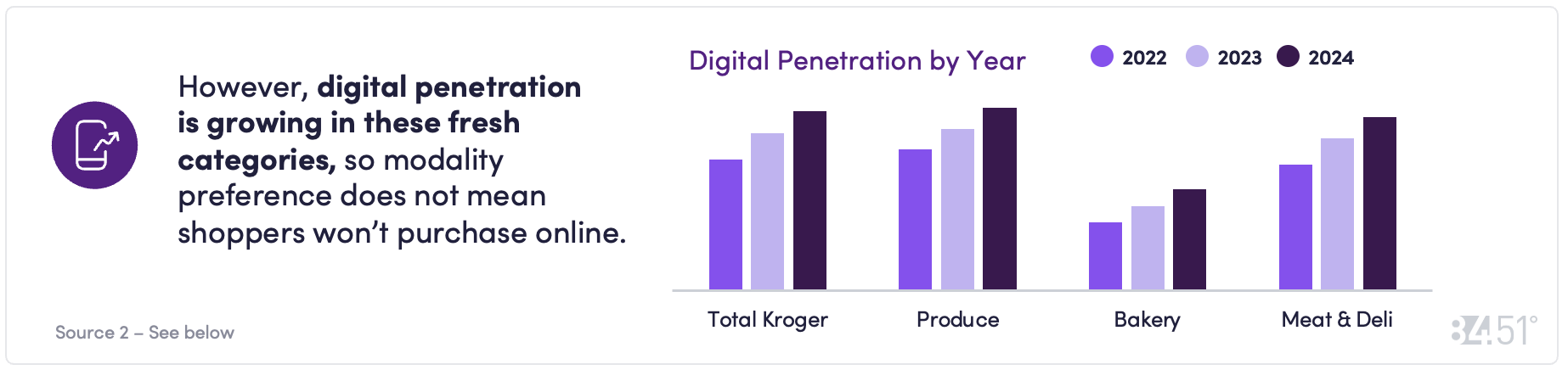

Freshly picked categories (Meat, Bakery, Produce) top the types of categories omnichannel shoppers prefer to shop in-store.

Freshness and the ability to personally select are the top reasons people prefer to buy Produce, Bakery, and Deli/Meat In-store. This allows them to both get the quality they want and buy what fits their household size and budget.

Why do you prefer to purchase certain categories in-store

“I prefer produce to be as fresh and non bruised, damaged as possible. I prefer certain meats, fish to be as lean as possible. Smaller portions, cuts are Important to a household of two.”

“I prefer shopping in store for things like produce, meats, and deli items to ensure they are fresh and good quality”

“I prefer to purchase some items in the store because I want to select them myself…I look for good quality and I try to find a price that matches my budget.

“To pick out what I prefer looks, size, etc.”

What’s important when online shopping?

Accuracy and item availability are the most important when shopping online.

Importance when shopping online for grocery & household items – Top 5 (T2B on 7-point scale)

93%: Accuracy of my order

86%: Availability of items on my list

79%: Ability to apply coupons or offers

70%: Ability to find items on sale or promotion

69%: Availability of time slots

Omnichannel shoppers have a variety of frustrations when shopping online, but product availability and substitution issues are among the most stated. Top frustrations chosen:

56%: Product availability

46%: Substitution issues

27%: Delivery fees

26%: Minimum order requirement

25%: Product quality concerns

19%: Limited delivery slots

16%: Technical issues

16%: Miscommunication

13%: Delivery delays

8%: None

4%: Other

Kroger defines a ‘personalized shopping experience’ as one that is tailored to your needs, individual preferences, and behaviors to make grocery shopping more efficient, convenient, and enjoyable.

When asked to describe a ‘personalized shopping experience’ at Kroger, our omnichannel shoppers placed the highest emphasis on personalized product & coupon recommendations based on prior purchases & buying patterns

42% of omnichannel shoppers say a ‘personalized shopping experience’ is very important (T2B) when shopping online at Kroger

However, there are situations where personalization can be a barrier:

“I don't need a lot of bells and whistles. Low prices and good deals are the most important thing.”

“Sometimes I miss new items or good alternate items by looking mostly at my previous items.”

“Sometimes the suggestion type things are a little creepy.... Like how did they know I was thinking about that....”

“Just because I bought something once doesn't mean I will need it again.”

A seamless experience is also expected!

49% of omnichannel shoppers expect everything to be the same when shopping the same retailer both in-store and online - from price & coupons, to product assortment & quality of products

There are some improvement opportunities for online shopping

Omni-shoppers have some ideas on how to enhance and improve shopping online:

Availability/In-stock was the most mentioned improvement theme, many times paired with substitution recommendations.

Coupons were also mentioned frequently, where respondents would like more coupons, coupons to be automatically applied, and to see the subtotal of the item with the coupon applied vs. at checkout.

While availability/in-stock is the most mentioned improvement area, if a grocery item received from their online order is not to their expectation, majority of omni shoppers will take action

What are you most likely to do if a grocery item you receive from your online order is not to your expectation?:

42%: Message customer service through the app/site to request a refund

19%: Call customer service to request a refund

16%: Return the item to the store

11%: Keep the item

5%: Throw the item away

5%: Keep the item and order a replacement

2%: Give the item away

1%: Other

In fact, ¾ of shoppers say they’ve gone in-store the same day as a Pickup or Delivery order.

Top reasons for in-store trips on the same day as pickup or delivery

50%: I forgot to add something to my online cart

27%: An item I wanted was out of stock

22%: To pick up prescription only item at the in-store pharmacy

SOURCE: 84.51° Real Time Insights, February 2025

Visit our knowledge hub

See what you can learn from our latest posts.