Consumer Digest: Omnichannel Trends February 2024

Welcome to the February edition of the Consumer Digest, where we provide relevant, informative and actionable insights around consumer trends. This month, we focus on who omnichannel shoppers are, where they shop, and some of the reasons why they choose to shop in-store and online, including for new items. Then we'll look at how they build their baskets and what’s important to them.

Note: the base used for this study included only those who shopped both in-store and online at Kroger over the past 52 weeks.

Who is the omnichannel shopper?

The omnichannel shopper is someone who buys groceries both online and in-store for their grocery and household needs. They are also called hybrid shoppers.

Say – Only 40% of omni-shoppers say they shop mostly online; they all do at least some in-store shopping

40%: Most in-store, some online

40% Most online, some in-store

20% Online and In-store equally

DO – Omni-shoppers still make 83% of their trips in-store

83% of Trips are In-Store

17% of Trips are Pickup/Delivery

Why are omnichannel shoppers choosing to shop online?

46% of omnichannel shoppers say that they spend less time ordering online compared to in-store. Over 80% of these shoppers who use Pickup/Delivery cite Convenience as the reason for doing so.

When shopping a retailer’s site, they prefer that the retailer completes their order. We asked the following: What best describes your order fulfillment preference when you order groceries/household items for delivery from a retailer's website?

61%: I prefer my orders fulfilled directly by the retailer I shopped (e.g., Amazon, Walmart or Kroger trucks)

24%: I do not have a specific preference

5% I prefer my orders fulfilled by third party shoppers (e.g., Instacart, Shipt)

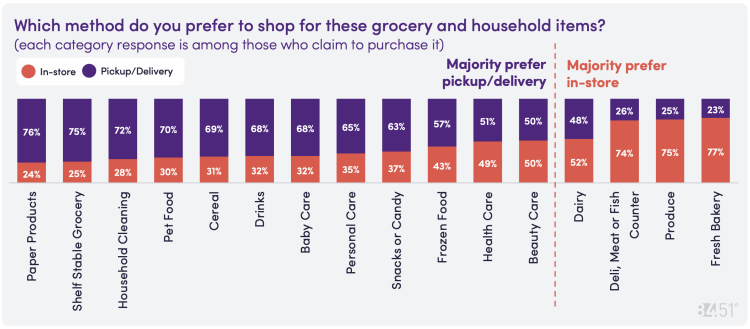

Omni-shoppers continue to prefer buying “fresh” categories in-store

Similar to our 2023 study, ~75% of omnichannel shoppers claim that they prefer to purchase Fresh Produce, Bakery and Deli/Meat/Seafood in-store.

Paper Products, Shelf Stable Goods and Household Cleaning are the most preferred for purchasing online.

Fill Rate: Acceptable substitutions by category

Categories shoppers are most willing to accept retailer suggestions:

Shelf stable

Paper products

Household cleaning

Categories shoppers are least willing to allow substitutions:

Health care

Beauty care

Pet supplies

Deli/Meat/Fish

What’s important to the omnichannel shopper?

Over 80% of omnichannel shoppers claim that order accuracy and availability are important when shopping online, and 23% will shift their spending elsewhere if items are out of stock.

Accuracy and Availability are so important, you may be missing out if items are out of stock.

Retailer Retained:

77%: Will purchase the item immediately in-store or during their next online or in-store purchase

Lost Sales for Retailers:

19%: Will buy the out-of-stock item online elsewhere

4%: Will switch their entire cart to a different online retailer that has the item in stock.

Importance when shopping online for grocery & household items – Top 5 (T2B on 7pt scale)

90%: Accuracy

84%: Availability

78%: Coupons

74%: Available Timeslots

73%: Ease of Navigating site or app

Omni-shoppers rely on a retailer’s site/app for inspiration

Additionally, almost 50% of omnichannel shoppers (and even more for younger shoppers) are using social media as inspiration for their shopping lists.

Omnichannel shoppers are still most likely to try new items in-store but will use Search or a dedicated section of a site to find those new items.

Which platforms or tools are omni-shoppers using to find inspiration for their shopping lists?

60%: Store Website or App

46%: Social Media

37%: Cookbooks

34%: Store Emails

29%: Blogs or Websites

25%: Brand/Product site or app

How do omni-shoppers seek information about “new Items” when shopping online for groceries/household items?

39%: Search Bar

38%: ”New Items” section of website

16%: Follow pop-up ads for new items while shopping

24% I don't’ seek out info on new items

10% I’m not sure if the items I search are “new”

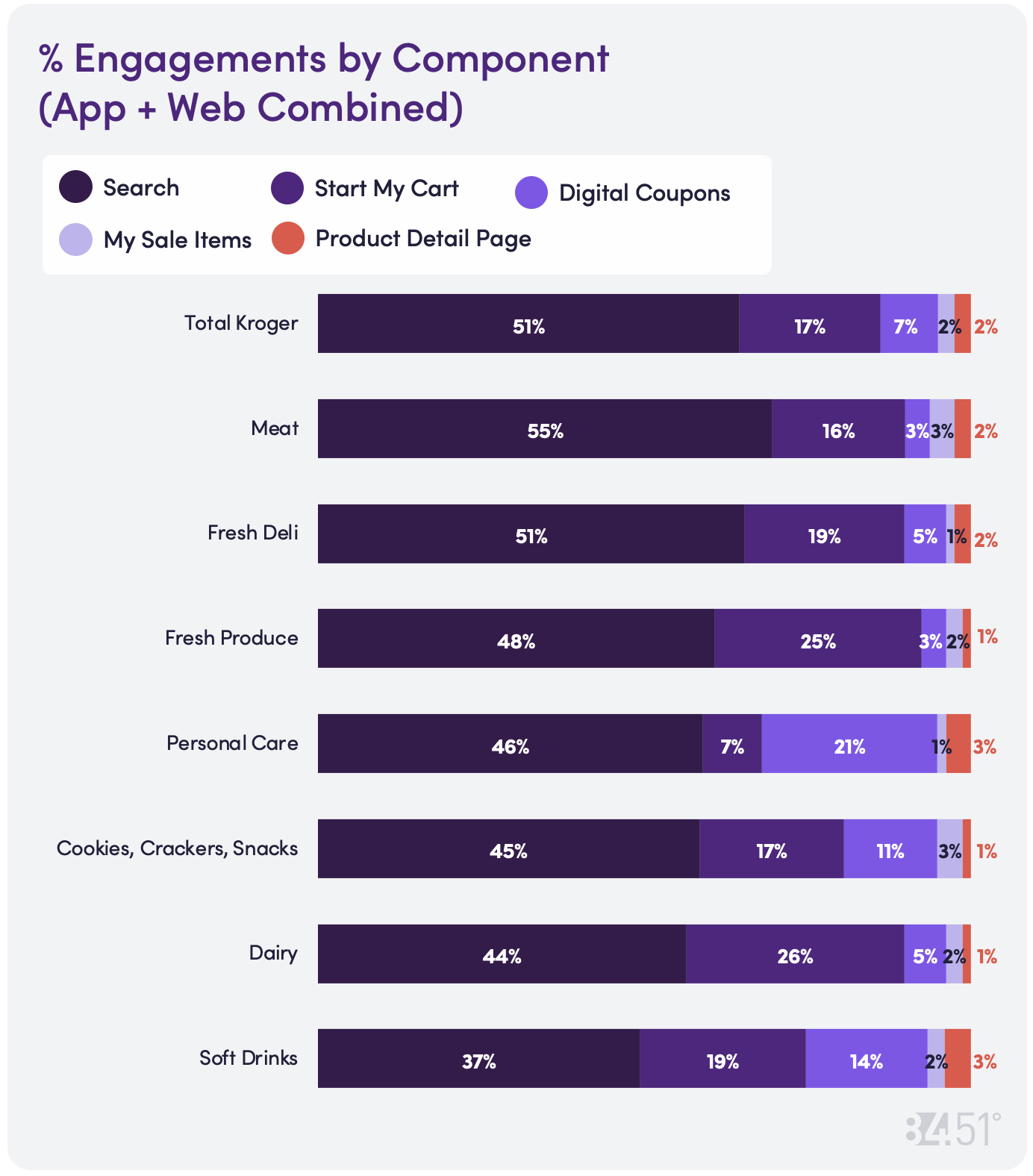

Clickstream analysis shows the actual path to purchase

Digital coupons are particularly important in driving conversion for Personal Care, Soft Drinks, Cookies, Crackers & Snacks

Start My Cart is particularly important in driving conversion for Dairy, Fresh Produce and Fresh Deli

In households with higher price sensitivity, the average Sales per [online] Order tend to be lower compared to the overall average. Conversely, households with lower price sensitivity typically exhibit higher spending per online order.

Branded vs. unbranded terms: How are people searching?

Top categories for BRANDED terms

Soft Drinks

Health (OTC/First Aid/Nutritional)

Baby

Cookies/Crackers/Snacks

Candy

Top categories for UNBRANDED terms

Refrigerated Grocery

Cards/Publications/Party Supplies

Fruit

Vegetables

Beef/Pork/Poultry

Each month. 84.51°’s Consumer Digest Report delivers relevant and actionable insights around consumer trends directly to your inbox. Now, for an incremental investment, 84.51° invites you to explore these insights the way you want via the 84.51° Consumer Digest Dashboard.

SOURCE: 84.51° Real Time Insights, February 2024

Visit our knowledge hub

See what you can learn from our latest posts.