Consumer Digest: January 2023

Welcome to the January edition of the Consumer Digest, where we aim to provide relevant, informative and actionable insights around consumer trends. As we start the new year, our thoughts turn to food and its connection to health. We explore consumer motivations and expectations around functional food benefits –AKA– food as medicine. Speaking of food . . . what will we plan to munch on during the big game and for Valentine’s Day?

A new year with new concern

As we begin a new year and reflect on 2022, we have seen a steady decline in overall concern with COVID with February 2022 seeing the highest concern at 34% and November and December seeing the lowest concern (Nov 14% and Dec 15%). With a recent rise in RSV incidences and cold and flu season at its peak, we decided to ask shoppers for the first time this month about their concern with overall contagious diseases and viruses.

24% of shoppers reported to be extremely concerned (T2B) with contagious diseases and viruses (e.g., COVID, Flu, RSV, etc.).

Those ages 55-74 are significantly more concerned (32%) than younger generations (e.g., 25 – 44-year-olds) who show 16% of extreme concern.

The majority of households with children feel neutral (53% middle three box) when it comes to their concern with contagious diseases and viruses.

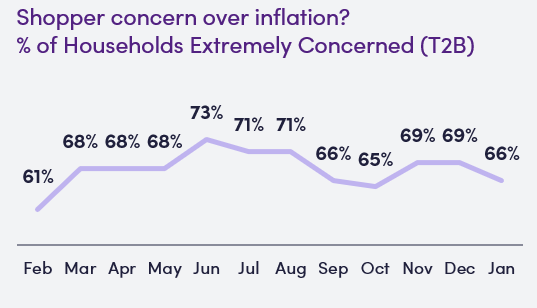

How shoppers are feeling regarding inflation and finances

How are shoppers planning to shop?

While most shoppers are planning to head to brick-and-mortar stores for their grocery and household items in the upcoming month, some will choose to order their items online to have them either shipped to their home or pick up at the store.

78% of shoppers plan to shop in-store most often for their upcoming month’s groceries and household items – those ages 45+ are planning to shop in-store significantly more so than those ages 18-34.

11% will order their groceries and household items online to have them delivered to their home, while 10% will use online ordering for pickup at the store (or other designated location) most often.

Roughly 70% of shoppers say they do not plan to shift their online purchase habits this upcoming year from what they did last year.

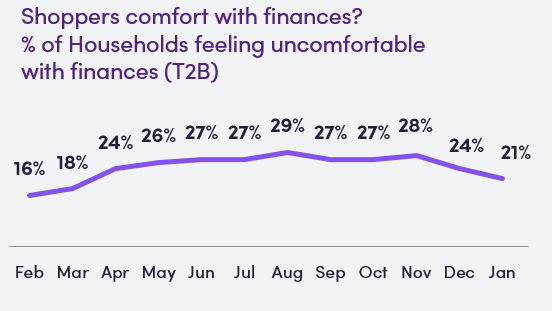

What is driving shoppers to shop a certain modality?

46% of shoppers claim to shop in-store because they do not trust someone else picking out their grocery products for them.

43% of shoppers claim to shop online using delivery because it’s easy to use the store’s website / app for shopping, while 33% claim to shop online for pickup for the same reason.

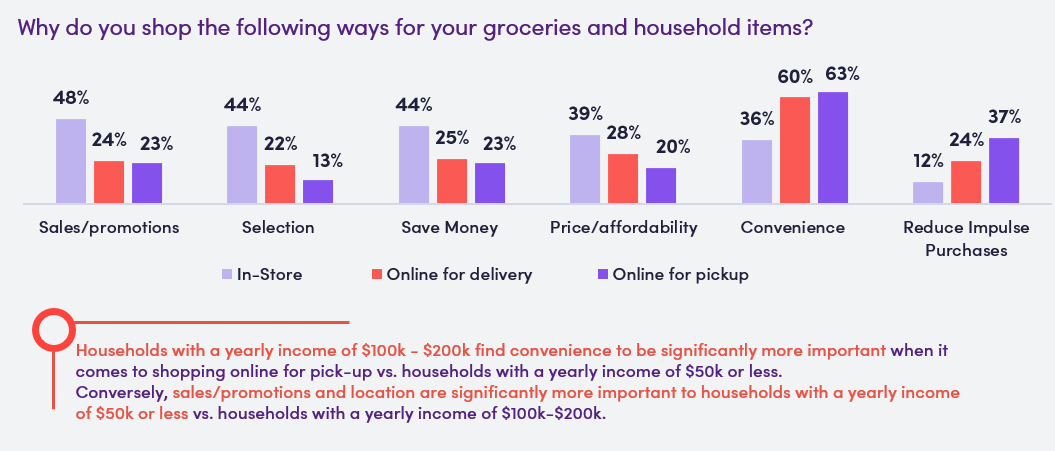

Consumers seek functional benefits through food choices

Top focus areas differ by age group, but common themes center on energy and heart health with 18-34 group placing emphasis on gut health

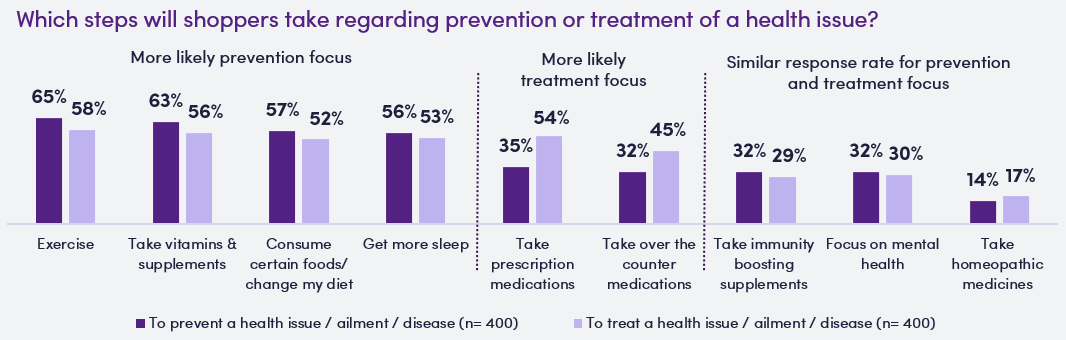

For some, diet and exercise are viewed as medicine

For prevention or treatment of an issue, the most common actions taken link to exercise and vitamins/supplements

Role of product labels can differ based on shopper focus as well as by category

What % of shoppers view these claims as extremely important?

34% - 100% Natural

29% - Non-GMO

22% - Organic

In what categories do shoppers report the highest rate of reading labels for benefits, claims, ingredients, etc.?

73% Health Care (OTC/Vitamin/First Aid/etc.)

66% Shelf-Stable (Canned Goods/Pasta/etc.)

65% Frozen Food

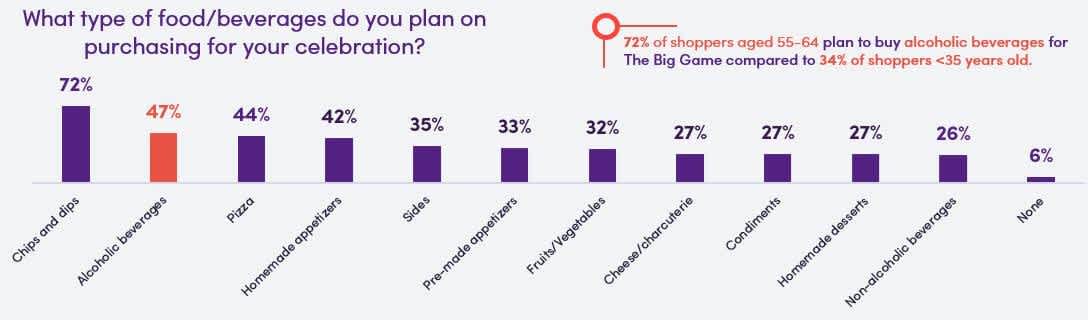

The Big Game sentiments

71% of shoppers plan to watch The Big Game – with the majority doing so at home and with a similar sized group as last year

Do you anticipate gathering with more people, less people, or about the same for The Big Game this year?

53% Same

12% Less

7% More

Where do you plan to watch The Big Game?

53% At my house with friends/family

23% At a friend/family member’s house

18% At my house alone

4% At a bar or restaurant

2% Other

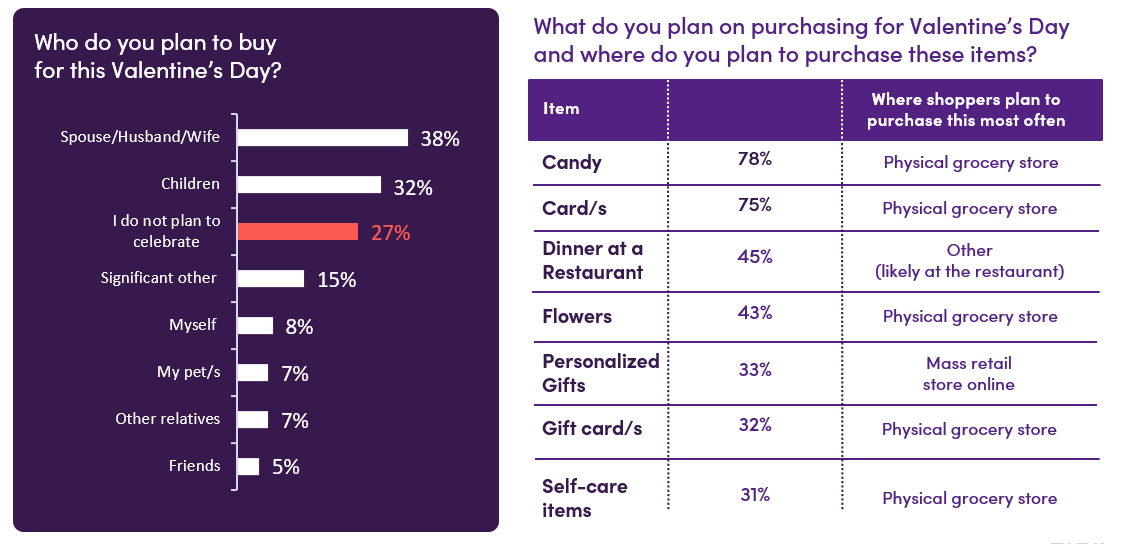

Valentine’s Day vibes

SOURCE: 84.51° Real Time Insights, January 2023

Visit our knowledge hub

See what you can learn from our latest posts.