Consumer Digest: Holiday Insights September 2024

2024 Holiday Outlook

The National Retail Federation (NRF) forecasts that 2024 winter holiday spending is expected to grow between 2.5% and 3.5% over 2023, which is consistent with NRF’s forecast that annual sales for 2024 will be between 2.5% and 3.5% over 2023.

To get a preview of the next few months, we asked Kroger households about their preparations and attitudes for the holiday season October through December.

Updated 10/30/24 based on 10/15/14 NRF Report

96% of respondents plan to celebrate one or more upcoming holidays:

Halloween: 65%

Thanksgiving: 89%

Christmas: 91%

New Years Eve/Day: 69%

Shopper priorities: What are shoppers looking for while holiday shopping?

Sales/deals/coupons available: 71%

Availability of items: 70%

‘One-stop-shop’: 34%

Personalized shopping experiences (e.g., promos, rewards, support): 26%

Online ordering for delivery or pickup: 22%

Extended store hours: 19%

Vibe check: Top two responses around holiday spending show budget concerns (T2B):

My household is concerned about our budget when we think about holiday spending this year: 44%

My household plans to shop at stores that offer the steepest discounts during the holiday season: 43%

Anticipated holiday spending…91% of shoppers will spend the same or less compared to last year:

Spend more: 10%

Spend same: 54%

Spend less: 37%

Although shoppers are looking for ways to save, many will continue splurging on gifts and food:

Gifts: 44%

Food: 43%

Travel: 18%

Clothing: 17%

Holiday entertainment: 16%

Decorations/décor: 14%

Holiday parties: 12%

None of the above: 25%

Shoppers plan to do more low-cost activities and cut back on higher cost activities.

More:

Gather with friends/family: 31%

Watch holiday movies: 29%

Prepare for gatherings: 18%

Buy groceries: 18%

Decorate my house: 17%

Less:

Go out to restaurants: 52%

Spend money on entertainment: 39%

Travel: 31%

Consume alcohol: 28%

Donate to charities: 27%

Where will shoppers search for holiday deals?

Digital coupons: 75%

Weekly ads/circulars (paper or digital): 65%

Retailer’s website: 60%

Retailer app: 52%

Cashback apps/sites (e.g., Rakuten, Ibotta, etc.): 36%

Personalized paper coupons: 34%

By word of mouth: 27%

Manufacture’s website: 25%

% of shoppers who plan to let technology do some of the holiday planning:

For gift ideas: 21%

For new recipes: 21%

To make a grocery list: 20%

Discover new holiday traditions: 10%

To learn about holiday meaning/history: 9%

Plan a holiday trip: 9%

Top triggers to start holiday shopping:

Specific sales (Labor Day, Black Friday, etc.): 56%

Seeing holiday decorations/décor in-store: 31%

Family and friends starting their shopping: 30%

When do Kroger shoppers typically start planning for the fall/winter holidays?

Halloween: 47% plan 2 weeks – 1 month ahead

Thanksgiving: 59% plan 2 week – 1 month ahead

December Holidays: 63% plan 1-3 months ahead

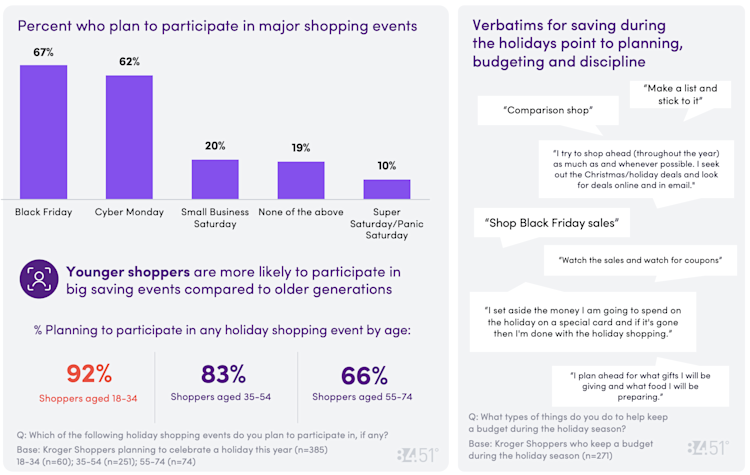

Holiday Sales Event Spotlight: Black Friday and Cyber Month, the two biggest events appeal to all generations, though with a skew to younger shoppers.

2024 Halloween Spotlight

Shoppers are sticking to the tried-and-true Halloween traditions and will make seasonal purchases to celebrate.

How shoppers are celebrating Halloween:

Decorating my house: 53%

Carving a pumpkin: 48%

Staying home & handing out candy: 43%

Stocking up on candy to give out: 36%

Stocking up on candy for myself/family: 36%

Going trick or treating in our neighborhood: 33%

Going to a trick or treating event: 27%

Going to a Halloween party: 26%

Going trick or treating in someone else's neighborhood: 23%

In-store shopping is favored for Halloween purchases

Where shoppers are planning to shop for Halloween:

Decorations:

Physical Mass Retailer: 43%

Physical Grocery Store: 33%

Will not be purchasing this year: 26%

Candy:

Physical Grocery Store: 62%

Physical Mass Retailer: 43%

Club Store: 23%

Costumes:

Will not be purchasing this year: 37%

Physical Mass Retailer: 25%

Online Mass Retailer: 19%

Say vs. Do: Halloween day is biggest for candy sales!

Shoppers are looking for deals and savings on candy, decorations and costumes. % of shoppers looking to cut back on Halloween supplies:

Candy: 37%

Decorations: 36%

Costumes: 30%

Food for gathering: 22%

Beverages for gathering: 22%

I do not plan to cut back on any Halloween supplies: 28%

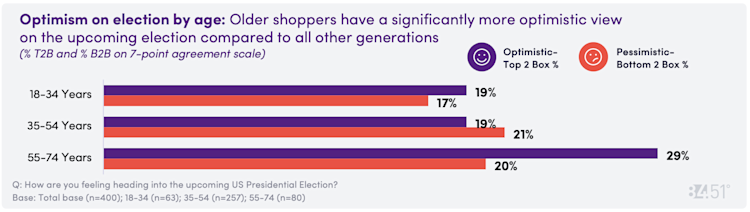

2024 U.S Presidential Election Engagement and Outlook

To what extent are shoppers keeping up with the Election? (T2B, M3B, B2B on 7-point scale)

Extremely engaged: 34%

Moderately engaged: 57%

Extremely unengaged: 9%

Financial procrastination related to 2024 Election

The top 3 things shoppers are holding off doing until after the Election:

Holding off on buying a big-ticket item: 18%

Holding off on investment decisions: 15%

Holding off on purchasing a car: 13%

Are not holding off on doing anything until after the election: 53%

% of shoppers holding off on purchase decisions by age:

Shoppers 18-34: 62%

Shoppers 35-54: 44%

Shoppers 55-74: 42%

Source: 84.51° Real Time Insights Survey, September 2024.

Visit our knowledge hub

See what you can learn from our latest posts.